The Evolution of Automated & High Frequency Trading (HFT)

From Slow Trades to Lightning Speeds: The Transformation of Financial Markets

It’s been a while since I first stumbled into the world of high-frequency trading (HFT), and I’ve been fascinated by the sheer depth of intellectual firepower that drives this field. Recently, I picked up an incredible book — Developing High Frequency Trading Systems by Sebastien Donadio, Sourav Ghosh, and Romain Rossier — and even though I’m just getting started, it’s already been an eye-opener. A huge shoutout to this masterpiece! Many of my upcoming blogs on HFT will be inspired by my readings and insights from this book, so if you're interested in the subject, I highly recommend checking it out.

Trading as an activity has always been about speed. Ancient merchants used fast ships and postal couriers to gain an edge in business by enabling a temporary asymmetry in information and translating this into financial profits. One of the earliest recorded instances of high-speed trading occurred in 1790, when traders, aware of Alexander Hamilton’s proposal to absorb state debts, hired fast boats to reach southern states and buy government bonds before news of the Act spread. This early form of arbitrage highlights how traders have historically sought technical advantages and speed to front-run market information.

High-Frequency Trading (HFT) is an advanced form (subset) of Algorithmic Trading (AT) that operates on the principle of executing a massive number of trades / transactions within fractions of a second (micro-/nanosecond latencies). Unlike traditional trading, where decision-making is driven by fundamental or technical analysis over longer timeframes, HFT systems rely entirely on automation, (ultra) low-latency infrastructure, and mathematical models to capitalize on minute price discrepancies across financial markets. Electronic trading platforms and exchanges, coupled with advancements in computing power and data transfer technologies, have fueled the exponential growth of HFT, making it a dominant force in modern financial ecosystems.

At its core, HFT is an intersection of multiple technical disciplines requiring a high degree of expertise in computer architecture, networking, operating systems, real-time data processing, and low-latency optimization. A typical HFT system is designed to process massive volumes of tick-by-tick market data, analyze the information in real time, and execute orders with ultra-low latency. Given that profitability in the HFT arena is closely dependent on microsecond-level execution speeds, firms that operate in this space invest heavily in hardware acceleration, direct exchange connectivity, and network optimization to gain a competitive edge.

While its roots can be traced back to the late 20th century, the field has evolved significantly over the past few decades with the introduction of electronic trading platforms like Instinet in 1969 and NASDAQ in 1971, the 1990s and early 2000s saw a sharp rise in fully automated trading systems. The launch of Island ECN and Archipelago in the late 1990s facilitated greater adoption of electronic trading, and by 2009, HFT was responsible for over 75% of the total equity trading volume in the US. However, with increasing regulation and a decline in arbitrage opportunities, the market share and profitability of HFTs have seen a relative decline since its peak in the year 2009.

Technical Infrastructure of an HFT System

An HFT system is an intricately designed stack of hardware and software components, optimized for ultra-low latency trade execution. The 3 primary components of an HFT system are hardware, networking subsystems, and the underlying software architecture.

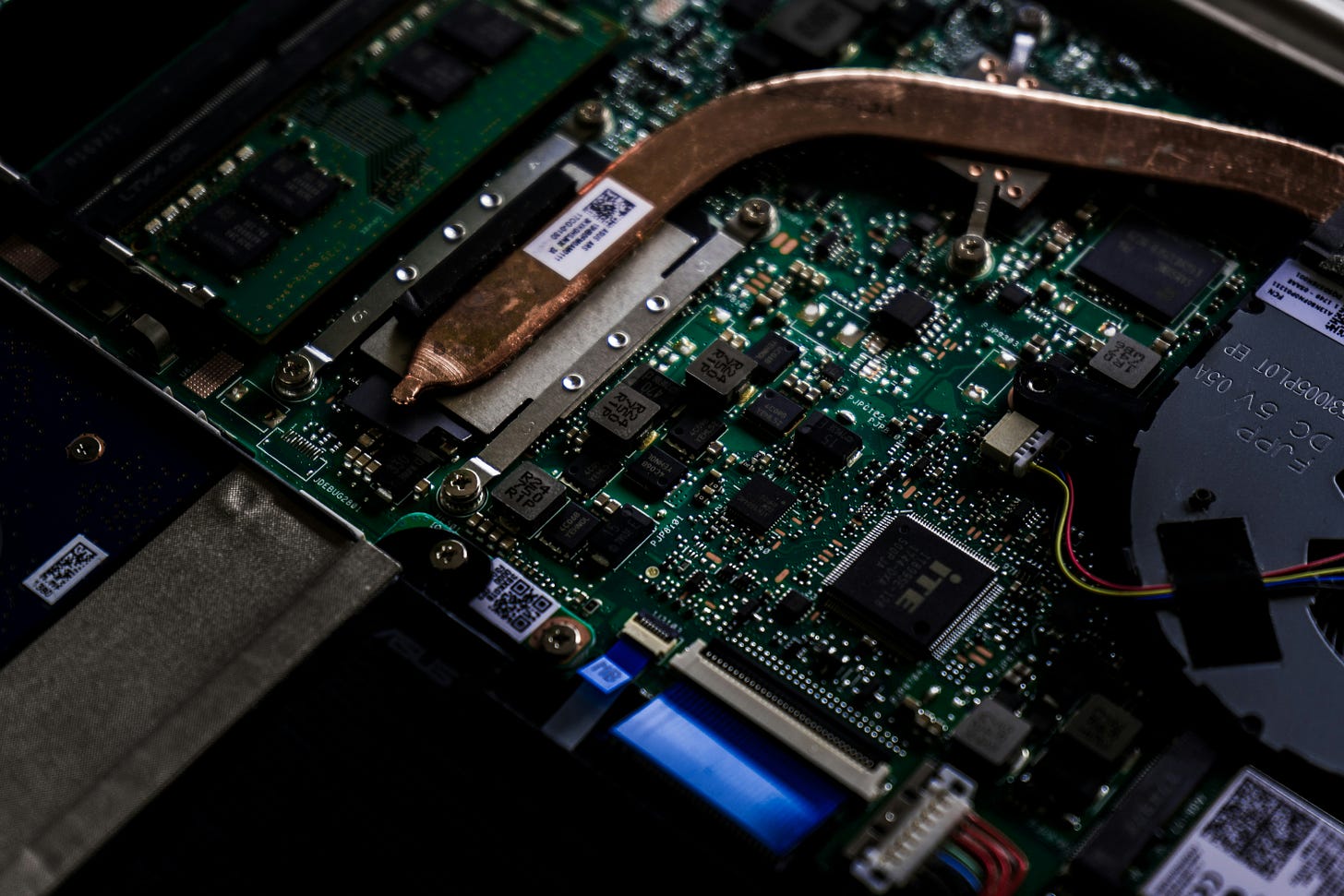

1. Hardware Optimization for Ultra-Low Latency Execution

HFT firms leverage custom-built, high-performance computing systems to ensure the lowest possible execution times. Unlike traditional financial applications that run on generic cloud-based infrastructure, HFT firms invest in bare-metal servers optimized for real-time data processing. These systems are often overclocked and stripped down to their essential components, running on real-time operating systems with minimal kernel overheads.

The core processing unit of an HFT system is typically built using high-frequency, single-core CPUs (rather than focusing on parallelism - mostly), as most HFT algos are designed to minimize processing latency rather than maximize multi-threaded performance. Field Programmable Gate Arrays are also commonly used for critical computation-heavy tasks. Unlike software-based processing, FPGA-based execution allows firms to implement custom logic at the hardware level, bypassing traditional operating system delays and reducing latencies to nanosecond levels.

Memory bandwidth and storage latencies are also key considerations in HFT infrastructure. Trading firms opt for high-speed DRAM and NVMe-based storage solutions to minimize access times for large-scale tick data repositories. In-memory databases are commonly used to store order book data, reducing I/O bottlenecks associated with disk-based storage solutions.

2. Low-Latency Networking: The Backbone of HFT

Networking is another super critical component of any HFT system. Since most modern financial exchanges operate at sub-millisecond speeds, every microsecond of delay in data transmission can result in significant changes in the PnL of HFT firms. To address this, HFT firms co-locate their trading infrastructure within exchange data centers, ensuring direct access to market feeds with minimal latency.

Colocation involves placing trading servers within the same physical data centers as the exchange's matching engines. This setup drastically reduces the time required for order execution compared to firms operating from external locations. In the US, the SEC mandates that all co-located trading firms use cables of equal length to ensure fairness, but firms still optimize their network stacks by using custom network interface cards (NICs) and kernel bypass technologies like Solarflare and Exablaze to further reduce latency.

3. Software Architecture and Algorithmic Execution

The software architecture of an HFT system is built around low-latency execution engines, real-time data processing modules, and risk management systems. Programming languages such as C++ and Java are widely used for high-performance trading applications due to their low-level memory control and execution efficiency. Python is often used for strategy development and backtesting but is rarely used in live trading environments due to its higher execution overhead.

A typical HFT algorithm follows a streamlined workflow:

Market Data Ingestion: Tick-by-tick price data from multiple exchanges is aggregated and processed from real time feeds.

Signal Generation: Quantitative models analyze price patterns, volume trends, and order book imbalances to identify trading opportunities.

Order Execution: Orders are executed within microseconds / nanoseconds using direct market access (DMA) via ultra-fast APIs.

Risk Management: Automated risk checks ensure that trades remain within predefined risk limits, preventing unusually high losses.

Some HFT firms also use machine learning and AI-based models to enhance their trading strategies. These models analyze historical price patterns, market sentiment, and alternative data sources such as news feeds to make predictive trading decisions. However, given the time-sensitive nature of HFT, traditional deep learning models are often too slow for real-time execution.

HFT Trading Strategies: Exploiting Market Inefficiencies

HFT firms deploy a variety of trading strategies, each designed to exploit specific market inefficiencies. Some of the most common HFT strategies include:

Market Making: Market makers continuously place buy and sell orders, profiting from the bid-ask spread. Speed is critical as firms compete to maintain the best quotes.

Arbitrage Strategies

Statistical: Quantitative models to exploit price diff between corr assets.

Latency: Capitalizes on microsecond delays in market data dissemination.

Dark Pool: Identifies hidden liquidity in off-exchange trading venues and executes trades before large institutional orders impact the market.

Momentum Ignition: Intentionally triggers price movements by placing large orders and exploiting the subsequent market reaction.

Pinging: Small orders are placed to detect institutional trades, allowing HFT firms to front-run large buy / sell orders.

Each of these strategies require lightning-fast execution and advanced risk management mechanisms to remain profitable in high-volatility environments.

Regulatory Challenges and Ethical Concerns in HFT

While HFT has been widely adopted across global markets, the domain has also faced significant scrutiny from regulators and market participants. Concerns over market manipulation, front-running, and spoofing have led to tighter regulations in major financial markets across the world for HFT firms.

In 2014, the New York Attorney General sued Barclays for allegedly misleading investors about the presence of HFT firms in its dark pool. Similarly, regulatory bodies like the SEC and FINRA have implemented measures to curb manipulative practices, including minimum order resting times and transaction taxes aimed at slowing down predatory trading behaviors.

Despite regulatory challenges, HFT remains a fundamental part of modern financial markets. With the rise of digital assets and crypto, HFT firms are now exploring opportunities in decentralized finance (DeFi) and cryptocurrency exchanges such as Binance, Coinbase, and FTX (now defunct). The domain is currently undergoing a rapid change with advancements in the technological landscape and only those firms that can stay up to date shall profit from the ever-changing market dynamics.

The evolution of HFT and related technology for faster communication of information and real time decision making via smart systems, continues to be driven by advancements in hardware acceleration, AI-driven trading models, and high-speed networking technologies. As traditional equities markets become more regulated, crypto markets provide new frontiers for HFT strategies, albeit with increased volatility and fragmented liquidity. These challenges are areas of active research and untapped opportunities waiting to be explored.

For those looking to enter the world of HFT, mastering low-latency programming, networking optimization, and quantitative finance is essential. The barriers to entry remain high, but for firms that successfully navigate this complex landscape, the rewards can be immensely rewarding.